Table of Content

They require no down payment at closing – as opposed to the typical 20% – and are fully financed by the lender. Even with no down payment, though, closing costs will still apply. However, previous homebuyers may also qualify as first-time homebuyers if they have not owned a home in the past three years. Certain DPA programs are designed for specific groups of people, including police officers, teachers, city employees, and emergency responders.

Because your down payment is lower than 20%, your lender will require you to purchase private mortgage insurance . This insures your lender if you end up defaulting on the loan, but won’t really benefit you or your home personally, even though the payments are coming out of your pocket. Fortunately for you, you’ll be able to cancel your PMI as soon as your home’s equity reaches 20%. The IRS allows qualifying first-time homebuyers a one-time, penalty-free withdrawal of up to $10,000 from their IRA if the money is used to buy, build, or rebuild a home.

Down Payment Assistance Loans in OK, TX, & AR

Si, a victimization in having plenty of litigation is desperate for assistance of Phoenix. Buyers must meet certain criteria to utilize OHFA Homebuyer and Closing Cost Assistance. To determine a property’s eligibility can be done by doing a property search using the USDA eligibility map.

VisitOHFAfor more information on Oklahoma’s housing programs. The most obvious benefit is that the loan product does not require a down payment. It is the only loan product for non-veterans that offers a true 100% feature.

Types of Mortgage Loans Available in Oklahoma

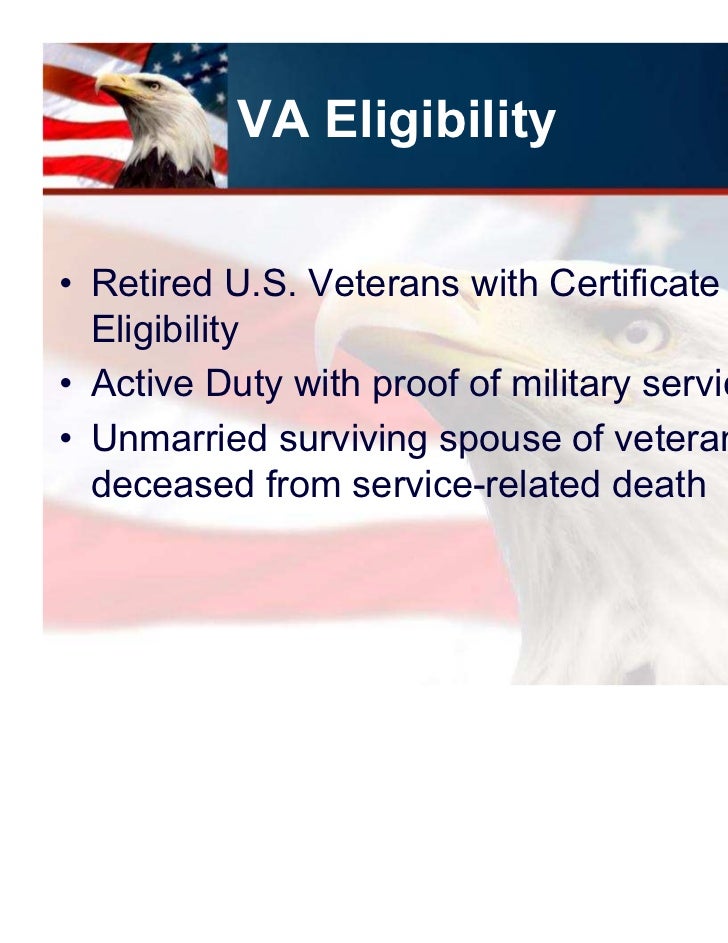

Borrowers who do not meet the career requirements above can take advantage of the OHFA Dream product, which also works by supplying a 3.5% down payment grant. The Dream program is not limited to first time home buyers, but participants must have a 640 credit score. VA loans, backed by the Department of Veterans Affairs, are no-down-payment home loans available to eligible service members or veterans. A VA mortgage is originated by private lenders and insured by the VA, and requires no down payment or mortgage insurance fee.

Griffin Funding can work with potential home buyers of all backgrounds in order to find the right home loan. Whether you’re a first-time home buyer or a real estate investor or are trying to rebuild your credit, we can assist you in finding an Oklahoma home loan tailored to your needs. On the other hand, the interest rate on an adjustable-rate mortgage can fluctuate depending on real estate market conditions. While adjustable-rate mortgages offer less certainty, you can potentially save money if interest rates drop but risk paying a higher interest rate if market rates swing upwards.

Get Your Free Rate Quote Now!

To provide you with a personalized experience and deliver advertising specific to you, SoFi may share some of your personal information with our 3rd party partners. If you do not allow this by either your browser settings or if you select "No (Opt-Out)" in the toggle below, you will experience less targeted advertising from our partners. They are harder to get than FHA or Conventional Loans - This just isn't true. In many cases, USDA Loans are actually easier to get because the loans are guaranteed by the government. They aren't flexible - Actually, USDA Home Loans can be used to buy a new home or refinance to a lower rate.

OHFA offers 3.5% of the total loan amount for your home purchase, reducing out-of-pocket costs. Some products and services may not be available in all states. Programs, rates, terms and conditions are subject to change without notice. If you’re unsure which program to choose for your first mortgage, your lender can help you find the right match based on your finances and home buying goals. When you meet with a loan specialist from Griffin Funding, you will get to discuss all the details of finding the right mortgage for your new home.

OFFICE HOURS

You usually have to pay back the loan within five years, but if you’re using the money to buy a house, you may have up to 15 years to repay. There are a variety of programs available to assist borrowers within the military community. Oklahoma AgCredit is committed to coordinating with other lenders, government agencies and other entities to train, educate and to provide financing for borrowers who have served in the military. This 80/20, 100% no down payment Conventional loan product does not require PMI in the payment. This home loan is set up as 2 loans, one at 80% LTV on a 30 year fixed rate and the other loan for 20% LTV on a 15 year fixed rate. Credit score of 640 or above is required and it's possible one can finance some of the closing costs in the loan.

OHFA grants people who serve the community and are applying for a Gold or Dream Loan an additional 0.125% interest rate discount off their quoted mortgage rate. Only certain people can qualify - Anyone who meets the income and credit guidelines can qualify for a USDA Home Loan. Oklahoma AgCredit can coordinate with other lenders to help you get the best deal. We can work with other lenders, government agencies, and co-signers to develop joint financing. Fixed rates with long-term maturities that have consistent payments help manage risk and cash flow.

In most cases, demonstrating a stable income and a credit score that is above 700 will enable you to secure approval for more loan options and benefit from low interest rates and favorable terms. When you apply for a mortgage in Oklahoma, the requirements for the loan will depend on a number of factors. Each type of mortgage has its own requirements, and you will qualify for the lowest interest rates when you exceed the minimum qualifications for each type of loan. When it comes to mortgages in Oklahoma, Griffin Funding is here to provide you with flexibility and solutions that enable you to buy a home.

DPA programs are usually available on a state, county, or city level, with each having its own terms and requirements. Financial Concepts Mortgage is here to help you apply for down payment assistant programs in Oklahoma.Get in touch with us todayto learn more or speak with one of our loan officers. The FHA, which is part of HUD, insures mortgages for borrowers with lower credit scores. Homebuyers choose from a list of approved lenders that participate in the program.

Home prices there rose 16.6% year-over-year according to Realtor.com. The median list price of homes in Oklahoma City was $275,000 in October of 2022. That was an increase of 3.8% year-over-year according to Realtor.com. Meanwhile, REI Oklahoma says it offers a “gift of 3.5%, 4%, or 5% of the total loan amount” on FHA, VA, and USDA loans.

You may also withdraw up to $10,000 in earnings from your Roth IRA without paying taxes or penalties if you are a qualifying first-time homebuyer and you have had the account for five years. With accounts held for less than five years, homebuyers will pay income tax on earnings withdrawn. Several federal government programs are designed for people who have low credit scores or limited cash for a down payment.

No comments:

Post a Comment